Just How a Company Accounting Advisor Can Help Your Company Thrive

In today's affordable service landscape, the know-how of a service audit advisor can offer as a pivotal possession to your business's success. The complete level of their impact expands past these principles, revealing deeper understandings that can essentially transform your organization trajectory.

Financial Planning Methods

Efficient monetary preparation strategies are vital for companies intending to accomplish long-lasting stability and growth. These methods include an extensive method to managing monetary resources, projecting future revenues, and optimizing expenditures. By establishing clear economic objectives, organizations can create actionable plans that align with their total business purposes.

Cash flow monitoring makes certain that services preserve enough liquidity to satisfy operational demands while additionally planning for unforeseen expenditures. Situation evaluation allows services to prepare for various market conditions, aiding them to adapt their techniques as necessary.

Additionally, regular monetary testimonials are essential to analyze the performance of preparation strategies and make essential modifications. Involving with an organization bookkeeping consultant can boost this procedure, giving knowledge in financial modeling and danger evaluation. By executing durable economic planning methods, businesses can navigate financial uncertainties, maximize growth possibilities, and ultimately safeguard their monetary future.

Tax Optimization Strategies

Tax optimization methods play a vital function in boosting an organization's overall monetary wellness. By strategically taking care of tax obligation liabilities, business can significantly improve their capital and reinvest savings right into development possibilities. One effective technique is the cautious option of business frameworks, such as S-Corporations or llcs, which can give tax obligation benefits based upon the particular needs of business.

Additionally, making use of tax obligation credit scores and reductions is vital. Organizations must routinely evaluate qualified reductions for expenditures like r & d, energy-efficient upgrades, and worker training programs. Using tax loss harvesting can likewise help in offsetting gross income by offering underperforming possessions.

Moreover, implementing a tax obligation deferral technique allows companies to delay tax payments, consequently preserving funds for longer periods. This can be accomplished with retirement or investment accounts that use tax obligation benefits.

Lastly, involving with a well-informed company accounting expert can help with the recognition of these possibilities and guarantee conformity with ever-changing tax regulations. By using these strategies, businesses can successfully minimize their tax obligation concern and allocate resources much more efficiently toward attaining their calculated objectives.

Capital Management

Cash money circulation administration is vital for preserving the financial stability and functional effectiveness of a company. It includes the tracking, evaluation, and optimization of cash inflows and outflows to make sure that a business can meet its responsibilities while going after growth chances. Effective capital administration allows organizations to preserve liquidity, stay clear of unneeded financial debt, and strategy for future expenses.

A business accountancy advisor plays a crucial duty in this process by providing professional guidance on cash flow expenditure, budgeting, and forecasting administration. They can aid recognize fads in capital patterns, allowing organizations try here to make informed decisions concerning expenses and financial investments. By executing durable money administration methods, experts can aid in bargaining desirable settlement terms with distributors and maximizing accounts receivable processes to speed up money inflow.

Moreover, a company audit consultant can offer understandings right into seasonal changes and cyclical trends that may affect capital. This aggressive strategy makes it possible for companies to prepare for potential shortfalls and to utilize on possibilities throughout top periods. Overall, reliable capital administration, supported by a well-informed consultant, is essential for making sure an organization's long-term sustainability and success.

Performance Evaluation and Reporting

Performance analysis and reporting are essential parts of calculated service monitoring, providing vital understandings into functional effectiveness and monetary health. By methodically assessing crucial efficiency signs (KPIs), businesses can assess their progression toward objectives and determine areas requiring improvement. This analytic procedure makes it possible for business to recognize their monetary placement, consisting of efficiency, expense, and success administration.

A business audit expert plays a pivotal function in this procedure, making use of advanced analytical tools and methods to provide precise performance records. These records highlight trends, differences, and prospective operational traffic jams, permitting companies to make enlightened decisions (Succentrix Business Advisors). Moreover, the expert can facilitate benchmarking against sector criteria, which allows organizations to determine their performance relative to rivals.

By focusing on data-driven understandings, companies can improve their functional approaches and maintain a competitive side in the industry. Inevitably, reliable performance evaluation and reporting empower organizations to prosper by aligning their resources with their calculated objectives and cultivating sustainable growth.

Threat Administration and Compliance

Although companies make every effort for development and success, they have to additionally focus on threat management and conformity to safeguard their operations and track record. Effective risk monitoring entails recognizing possible hazards-- financial, operational, or reputational-- and creating approaches to minimize those dangers. This proactive method enables companies to navigate unpredictabilities and protect their article possessions.

Compliance, on the various other hand, ensures adherence to regulations, guidelines, and industry criteria. Non-compliance can cause serious penalties and damage to a business's reputation. A business accounting advisor can play an important role in developing durable conformity frameworks customized to details industry needs.

By carrying out regular audits and evaluations, these consultants help companies recognize conformity voids and execute rehabilitative activities. They can assist in creating internal controls and training programs that advertise a culture of conformity within the company.

Including risk management and compliance right into the overall service strategy not just decreases possible interruptions but also improves decision-making procedures. Inevitably, the competence of a service bookkeeping advisor in these areas can result in lasting growth and long-term success, making certain that business continue to be durable in an ever-changing company landscape.

Conclusion

In final thought, the proficiency of an organization audit consultant contributes in cultivating organizational success. By implementing durable financial preparation strategies, maximizing tax responsibilities, taking care of money flow effectively, and carrying out complete performance evaluations, these professionals add to informed decision-making. In addition, their duty in threat monitoring and ensuring conformity with guidelines improves organizational resilience. Inevitably, the tactical partnership with a company accounting advisor positions a firm to maximize growth opportunities while alleviating possible monetary difficulties.

In today's competitive business landscape, the expertise of an organization accountancy expert can offer as an essential possession to your firm's success. Involving with a service bookkeeping consultant can enhance this procedure, offering experience in monetary modeling and danger analysis - Succentrix Business Advisors. By applying durable economic preparation techniques, services can navigate economic unpredictabilities, take advantage of on development opportunities, and inevitably safeguard their financial future

One reliable technique is the mindful option of organization structures, such as LLCs or S-Corporations, which can offer tax advantages based on the specific demands of the service.

Eventually, the critical collaboration with a company accountancy expert placements a business to exploit on growth opportunities while reducing possible economic additional reading difficulties.

Ariana Richards Then & Now!

Ariana Richards Then & Now! Tatyana Ali Then & Now!

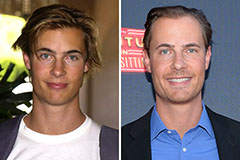

Tatyana Ali Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Traci Lords Then & Now!

Traci Lords Then & Now! Justine Bateman Then & Now!

Justine Bateman Then & Now!